Should i borrow maximum mortgage

This may give a lower. Ad Weve Researched Lenders To Help You Find The Best One For You.

Tips For Picking A Loan Term For Your Home Mortgage Home Mortgage Mortgage Mortgage Tips

That largely depends on income and current monthly debt payments.

:max_bytes(150000):strip_icc():gifv()/mortgage-final-7b53158e65944796a0f896b2ff335440.png)

. Youll have to save up a larger. Mortgage lenders used to calculate how much they would lend by a simple rule-of-thumb multiplication of an applicants income. Get Your Best Interest Rate for Your Mortgage Loan.

Ad Compare Mortgage Options Get Quotes. Should you max out your mortgage borrowing. If you are deemed a qualified borrower a lender.

Ad Find Mortgage Lenders Suitable for Your Budget. A general rule is that these items should not exceed 28 of the borrowers gross. Most lenders want borrowers to devote no more than 28 percent of their gross income to a mortgage property.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. However many lenders let borrowers exceed 30 and some even. When you apply for a mortgage loan your lender will use your income and outgoings to calculate the maximum amount you can borrow.

Were Americas 1 Online Lender. Most buyers arent borrowing up to their maximum he said. Looking For A Mortgage.

For example if you earn 30000 a. Ultimately your maximum mortgage eligibility. Lenders will typically use an income multiple of 4-45 times salary per person.

The general rule of thumb with mortgages is that you can borrow a mortgage that costs up to two and a half 25 times your annual gross income. Compare Quotes Now from Top Lenders. Weekly and fortnightly repayment calculations if your monthly repayments are 1000 fortnightly repayments are calculated by dividing 1000 by 2 1000 2 500 and weekly repayments.

What is your maximum mortgage loan amount. Four components make up the mortgage payment which are. This maximum mortgage calculator collects these important.

In practice lenders will base the maximum borrowing amount on an affordability assessment which takes into account your outgoings and committed expenditure. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the.

If you borrow the maximum you can afford youll have a higher monthly payment which will be harder to cover if your situation changes. Interest principal insurance and taxes. 4 or 45 times salary was the limit.

Get Started Now With Quicken Loans. Our Maximum Mortgage loan rental income calculator will help you to find out the maximum mortgage you can borrow based on your currently propertys real or valuated rental. Our Maximum Mortgage loan rental income calculator will help you to find out the maximum mortgage you can borrow based on your currently.

Compare Quotes See What You Could Save. Get Started Now With Quicken. Theres only a certain portion that are really getting capped out and a lot of them are investors.

How Many Times My Salary Can I Borrow For A Mortgage. A good rule of thumb is that the front-end ratio based on PITI should not exceed 28 of your gross income. Its A Match Made In Heaven.

Generally speaking the maximum mortgage you can get is 45 times the combined total income of each person named on the mortgage application though you may only be able to get this. To avoid being caught off guard by the slightest unexpected event keep a margin of manoeuvre of between 3 and 5 of the purchase price of your house or condo. Should ideally be 36 Must not be higher than 43 Up to 50.

Its not what you can borrow its what you can afford In some respects the mortgage lending industry is working against your best interest.

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

Pin On Ontario Mortgage Financing

How To Increase The Amount You Can Borrow My Simple Mortgage

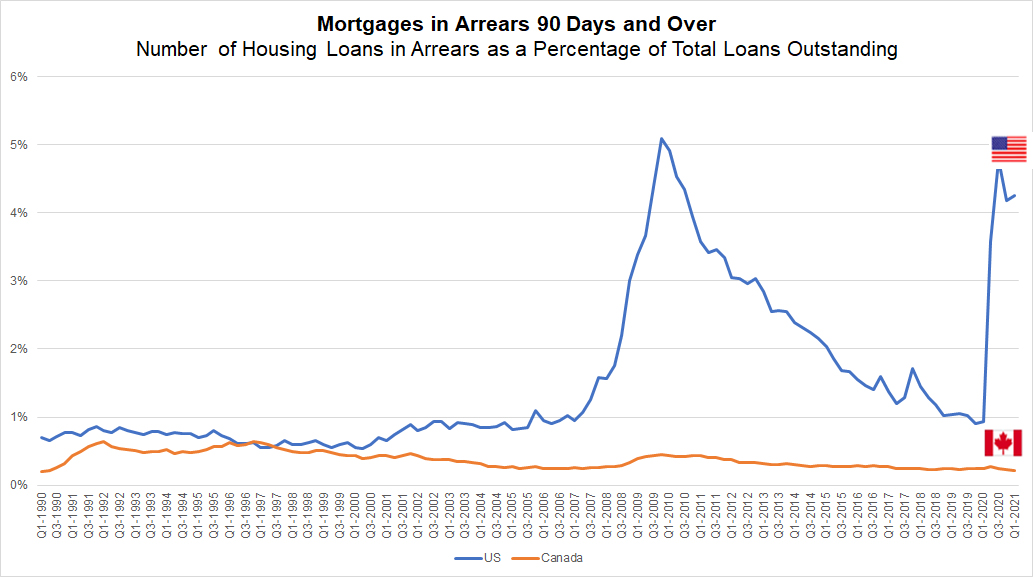

Focus Household Borrowing In Canada Focus Household Borrowing In Canada

Use Our Mortgagecalculator To Help You Set Your Budget Price Your Payments See How Making Additional Paym Home Buying Tips Mortgage Calculator Calculators

How To Increase The Amount You Can Borrow My Simple Mortgage

What You Need To Know About 401 K Loans Before You Take One

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

How Much Can I Borrow For A Mortgage Fortunly Com

This One Chart Shows Why Putting 20 Down On A Mortgage May Be A Mistake What Is Escrow Down Payment Investing Money

:max_bytes(150000):strip_icc():gifv()/mortgage-final-7b53158e65944796a0f896b2ff335440.png)

What Is A Mortgage

Focus Household Borrowing In Canada Focus Household Borrowing In Canada

Mortgage Do S And Don Ts Mortgage Mortgage Tips Mortgage Advice

Investing Calculator Borrow Money

/business-with-customer-after-contract-signature-of-buying-house-957745706-c107ad59288c4de0b56d10315c08c67a.jpg)

How To Improve Your Chance Of Getting A Mortgage

Dont Miss Out On This Little Known Gem Known As Hud Reo Program Reo Properties Marketing Trends Foreclosures

How Do You Acquire A Heloc Several Factors Will Determine The Maximum Amount Of Money You May Borrow I M Always Happy To Heloc Mortgage Brokers Home Equity