Total gross income calculator

As per income tax laws gross total income is divided into five parts. The importance of the AGI calculation is crucial as it represents the total income before including standard deductions or credits.

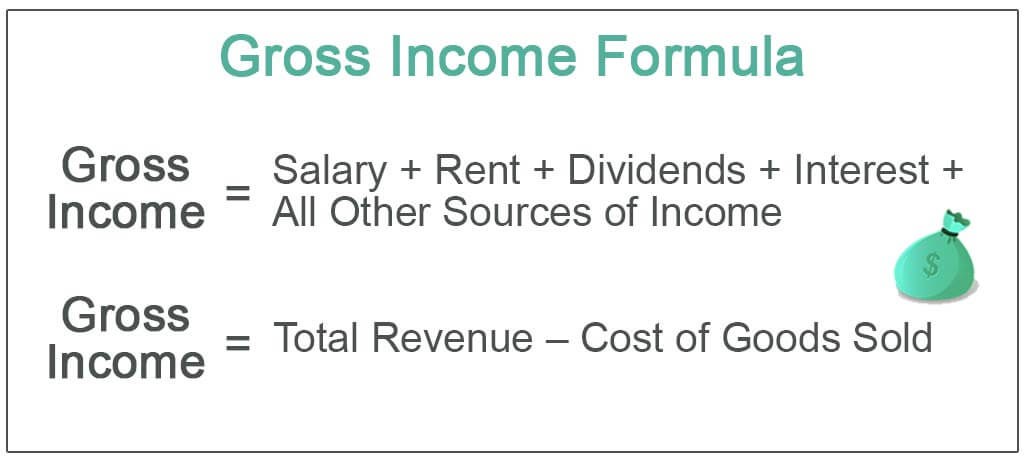

Gross Income Formula Step By Step Calculations

Covering more than 90 cities in China Direct HRs Salary Calculator provides total employer cost gross or net salary for any given value.

. Gross pay calculator Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. The calculator allows you to apply expenses to calculate the total expenses you cover as a landlord. Enter the Total Annual Income from Properties.

The basic difference between the old tax regime and the new. On your 1040 your business income and loss is calculated on Schedule C. Your gross wages from jobs.

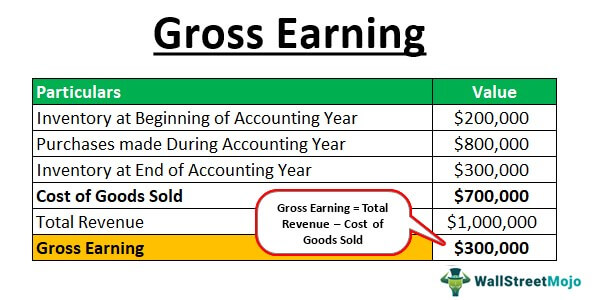

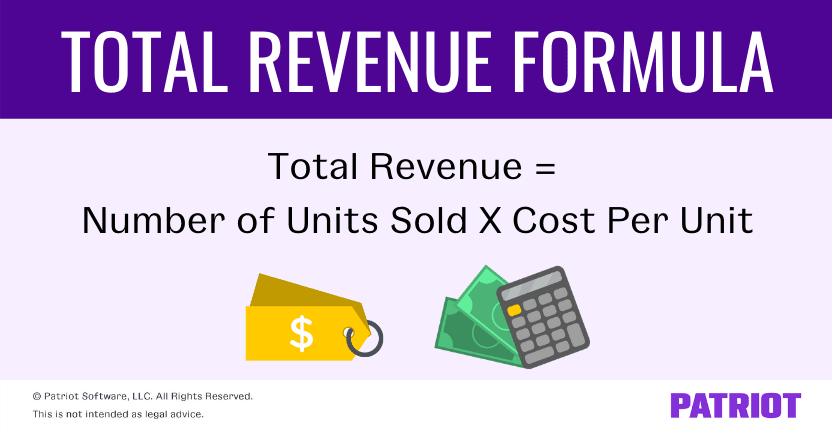

Gross Scheduled Income GSI. Here total sales are equal to total revenue of a company. Depending on your sources of income you will have to select the appropriate ITR form to file your tax return for FY 2021-22.

Your gross income or pay is usually not the same. The gross operating income multiplied by the vacancy rate. Pro-forma Income Statement Cash Flow.

Assuming a person has a gross total income of 1450000 per annum from all sources of income. You can calculate your net business income by subtracting your qualified business expenses including materials tools and labor costs from your gross earnings. How to Use the Landlord Income Tax Calculator.

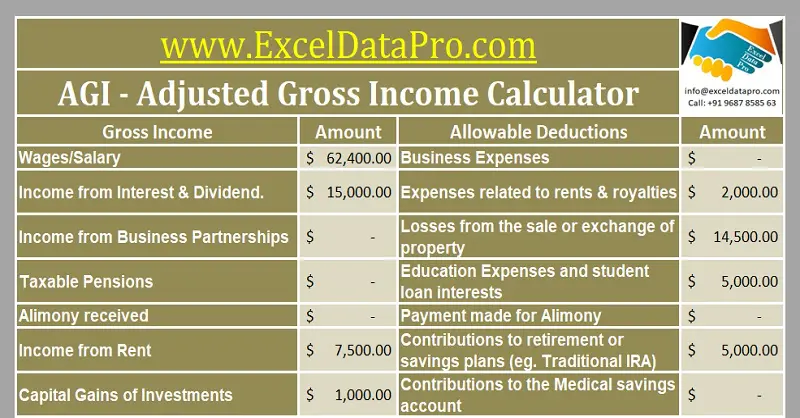

Adjusted gross income definition. Qualified educator expense deductions are capped at 250. Use Income Tax Calculator in India for free.

Gross Pay or Salary. Your taxable income is derived by adding income from all sources salary rent capital gains etc to get your gross total income and subtracting from this the deductions and exemptions you are eligible for. Your total monthly debt payments divided by your gross monthly income your wages before taxes and other deductions are taken out.

The withholding calculator will ask you for current year estimates of the following amounts. 529 Plan Ratings and Rankings. A back-end ratio includes.

Revenue for year 2018 100907 Revenue for year 2017 73585 Revenue Formula Example 3. The Landlord Income Tax Calculator is designed to be intuitive to use its all about making income tax easy to calculate and understand. Your spouses gross wages if married and filing jointly.

If you make the deductions from the amount of gross. Formula For Taxable Income is represented as. Gross Total Income abcde.

If you have a net gain from your business it counts as ordinary income. Assume that Sally earns 2500 per hour at her job. Income tax can be calculated using the simple formula.

This calculator determines the monthly payment and estimates the total payments under the income-based repayment plan IBR. Test Your Money Knowledge. Other Income laundry late fees.

Your total housing costs shouldnt be more than 25 of your take-home pay. Income from salary income from house property income from capital gains income from business and profession and income from other sources. School tuition and fees are capped at 2500 with 100 percent of the first 2000 and then 25 percent of the next 2000 eligible as a deduction.

Important Note on Calculator. A bakery sells 35 cookies packet per day at the price of 20 per pack to increase the sale of cookies owner did analysis and find that if he decreases the price of cookies by 5 his sale will increase by 5 packets of. Use our Monthly Gross Income Calculator to calculate your monthly gross income based on how frequently you are paid and your gross income per pay period.

It is purely based on the income tax slabs it falls under. There are some restrictions on specific AGI deductions to note when using our gross income calculator. Lets work through how to calculate the yearly figure by using a simple example.

While increasing your retirement account savings does lower your take home pay it. Individual Income Tax IIT. Total Actual Annual Income.

The maximum possible annual income you receive if everyone pays their rent. Taxes already paid in the. Income from the sale or rental of property.

Often abbreviated as AGI within United States income tax system the adjusted gross income represents an individuals total gross income minus his deductions thus many people refer to it due to a higher relevance in. What are the different types of Income-Driven. We also provide a Taxable Income calculator with a downloadable excel template.

The annual income collected after you deduct the vacancy amount. Gross pay is the total amount of money you get before taxes or other deductions are subtracted from your salary. Other income you might have including.

32000 21000 53000 Total gross annual income If Sarah is eligible for deductions of 5000 for education andor childcare expenses. This is the percent of your gross income you put into a taxable deferred retirement account such as a 401k or 403b. Income Tax Calculator - Learn How to Calculate Income Tax Online for FY 2022-23 AY 2023-24 with ICICI Prulifes Income Tax Calculator.

Income Tax Calculator - Calculate Income Tax Online for FY 2022-23 AY 2023-24 easily at Bajaj Finserv. A Modified Adjusted Gross Income MAGI Calculator helps you assess your eligibility for tax breaks tax credits or other government-subsidized programs. First enter the net paycheck you require.

You may also look at the following articles to learn more. Free online gross pay salary calculator plus calculators for exponents math fractions factoring plane geometry solid geometry algebra finance and more. Example of Annual Income Calculator.

This calculator helps you determine the gross paycheck needed to provide a required net amount. Income multiplies the federal poverty line for your family size by 15 then subtracts that from your adjusted gross income. Your debt-to-income ratio represents the maximum amount of your monthly gross income that you can spend on total monthly housing expense plus monthly debt payments such as auto student.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. See where you stand with our debt-to-income calculator below.

Salary Formula Calculate Salary Calculator Excel Template

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

How To Calculate Gross Income Per Month

Annual Income Calculator Discount 52 Off Www Wtashows Com

Salary Formula Calculate Salary Calculator Excel Template

Gross Income Calculator Online 56 Off Www Wtashows Com

Monthly Income Calculator Online 52 Off Www Wtashows Com

Gross Earning Meaning How To Calculate Gross Earning

Gross Income Formula Step By Step Calculations

Agi Calculator Adjusted Gross Income Calculator

How To Calculate Total Revenue In Accounting Formula More

Gross Income Formula Step By Step Calculations

Annual Income Calculator

Gross Income Formula Calculator Examples With Excel Template

Gross Income Formula Step By Step Calculations

Annual Income Calculator Deals 57 Off Www Wtashows Com

4 Ways To Calculate Annual Salary Wikihow